Nearly 40% of small businesses outsource payroll to a third-party processor.

How can you verify that your payroll tax deposits are being made?

While there are many benefits to outsourcing a company’s payroll functions, it’s important to note that employers who outsource payroll are still legally responsible for any and all payroll taxes due.

According to the IRS, “An employer’s use of a Payroll Service Provider (PSP) does not relieve the employer from its responsibility of ensuring that all of its federal employment tax duties are met. A PSP assumes no liability for their employer/clients’ employment tax withholding, reporting, payment, and/or filing duties.“

When you fully outsource payroll, you authorize a payroll service provider to remit income taxes withheld and both the employer’s and employees’ share of social security and Medicare taxes on your behalf. But how can you be confident that the payments are being made timely and accurately?

If you have doubt or uncertainty about your payroll service provider or you simply want to monitor the history of payroll tax payments that have been made on your behalf, there are several options.

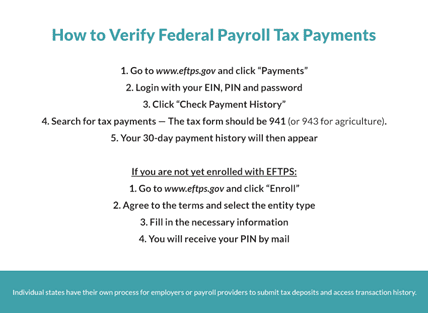

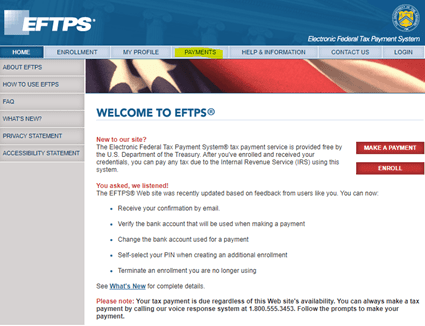

Access your Electronic Federal Tax Payment System (EFTPS) Account

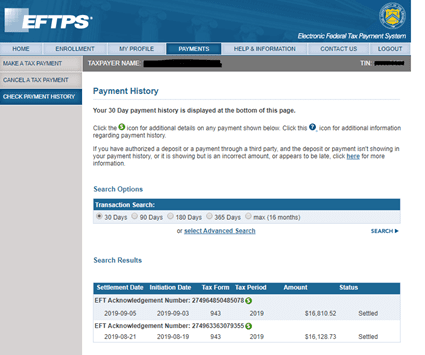

The EFTPS is a free website from the Treasury Department so employers can have safe and easy access to their deposit history, as long as payments are made using their Employer Identification Number (EIN). If you are signed up for EFTPS and have a pin, following are instructions to login and view your payroll tax deposit records.

- Go to www.eftps.gov

- Click “Payments”

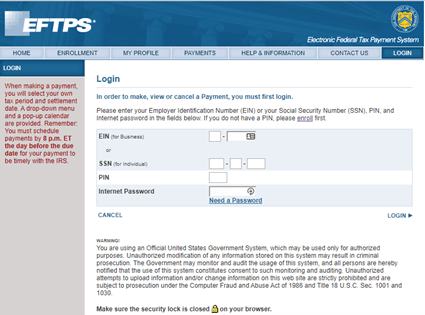

- Login with your EIN, PIN and Password

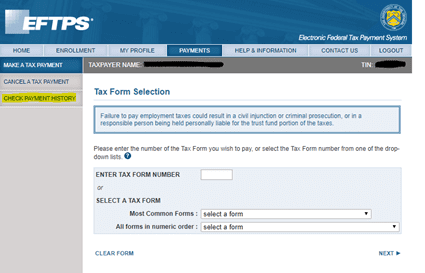

- Click “Check Payment History”

- Search for tax payments. The tax form should be 941 (or 943 for agriculture).

Your 30-day payment history will then appear.

Helpful Screenshots:

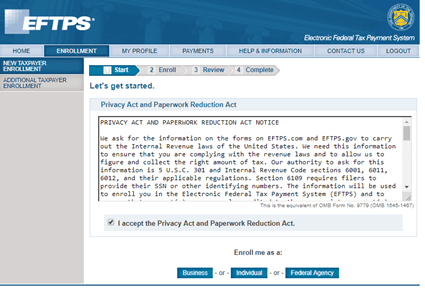

Sign Up for EFTPS

If you are not yet enrolled with www.eftps.gov, it is a good idea whether you outsource part or all of your payroll tax filing and reporting. By enrolling with EFTPS, you will be able to receive email notifications about account activities, payment reminders, and confirmations of payments. Follow the below steps to get signed up in order to view and make tax payments.

- Go to www.eftps.gov

- Click enroll

- Agree to the terms and pick the type of entity

- Fill in the necessary information

- You will receive your PIN by mail

- Follow the above instructions to login and access your records

Access Your State Tax/Treasury Account

The above EFTPS portal is for federal tax payments only. Individual states have their own process for employers or payroll providers to submit tax deposits and access transaction history.

- New Jersey Division of Taxation →

- Pennsylvania Department of Revenue →

- New York Department of Taxation and Finance →

- Delaware Division of Revenue →

If you suspect your payroll service provider of improper or fraudulent activities involving the deposit of your federal taxes or the filing of your returns, you can file a complaint using Form 14157 Complaint: Tax Return Preparer. You can mail the form, or fax it to 1-855-889-7957.

When you outsource your payroll, make sure you are handing over the responsibilities to a trusted professional. Abacus Payroll’s professionals are here to help. Send us an email at info@abacuspay.com if you have more questions about payroll tax deposits and reporting. If you’d like a no-obligation quote for outsourcing payroll, fill out our contact form or give us a call at (856)667-6225.